Leveraging data to drive business and marketing strategy.

Article: The Aftermath COVID-19 Whitepaper Summary - June 2020

By DHC Group

In response to questions from members, DHC Group, in partnership with Intouch Group, has spent the last 6 weeks evaluating how the impact of COVID-19 might permanently alter pharma sales and marketing. Through a series of thought leader interviews, stakeholder surveys, and expert analysis, DHC Group and Intouch Group compiled insights on navigating the evolving post-pandemic landscape, including professional and consumer engagement, the evolution of point of care and the role of telemedicine, the future of the field force, brand launches, the inevitability of digital transformation and more.

Our findings are available for download now in The Aftermath: COVID-19 Insights and Recommendations – How the Pandemic Will Forever Change Pharma Sales and Marketing whitepaper. The Aftermath offers a look at several key areas, so we invite you to grab a cup of coffee or glass of wine (depending on time of day or how quarantine is treating you!) and dig in. In this article, we will highlight just a few of the takeaways to get you started.

Telemedicine and Virtual Health Redefine the Scope and Extension of Patient Care

In evaluating the impact on the Point of Care and the resulting expansion of virtual health offerings, DHC Group, with member SERMO, surveyed physicians on their COVID-19 experience. Analysis of those results, along with input from industry experts, pointed to two key insights:

Telemedicine / Virtual Health has quickly become ingrained in the healthcare ecosystem. The momentum is in place for ongoing, increased use of telemedicine by patients and their providers, and the overall impact to the pharmaceutical industry is expected to be positive.

Making telemedicine a consistently effective substitute for face-to-face visits will take time. Pharmaceutical companies will have a role in helping professionals and patients make the transition to telemedicine less painful while supporting a broader shift to an overall ecosystem of connected health.

We also took a look at the impact of increased telemedicine volume on HCPs and patients through several data points from an InCrowd Novel Coronavirus (COVID-19) Non-Frontline Specialist Tracking Report.

Specialists report that they will still seek to limit exposure after stay-at-home guidelines are relaxed, mainly through the use of telemedicine, limiting patients in waiting rooms and screening before visits.

I think telemedicine will continue to be a part of routine care, which I think is a good thing. Patients don’t have to take time off work and doctors can work from home certain days.

– Hospital-Based Dermatologist

Less overbooking so that the waiting room will be less crowded. Wider spacing in the waiting room between chairs, and more disinfecting the rooms.

– Hospital-Based Cardiologist

Will screen people for fever/URI before visits – there’s no reason as a neurologist for me to see non-urgent clinic patients who are also sick with an infectious disease.

– Hospital-Based Neurologist

Source: InCrowd Novel Coronavirus (COVID-19) Non-Frontline Specialist Tracking Report – Wave 1

These research pieces informed our conclusions around possible benefits and challenges to long-term use of telemedicine. For example:

BENEFIT: Reclaimed time in HCPs’ schedules that can be used to see more patients or to improve the quality of in-person visits.

CHALLENGE: The need for a better-organized patient flow. Expect electronic health record (EHR) platform enhancements that provide integrated and automated scheduling, appointments, reminders and billing to reduce administrative burdens.

THE AFTERMATH: Our industry’s opportunity to support this connected health future will help drive a stronger and less burdensome health ecosystem for patients and empower HCPs to enhance remote care.

(see report pages 11-19 for full details)

(see report pages 11-19 for full details)

Health Professionals Still Need Rx Support ... and Their Preference is Increasingly Virtual

On review of the HCP research conducted during this project, several key insights were reached about the impact on physicians and how pharma will be required to shift in response.

Pharmaceutical sales reps pivoted to more virtual engagements with physicians, and these patterns, to some extent, will likely be retained.

Ultimately, the differentiated value a sales rep brings to the personal relationship with a healthcare provider (HCP) will be the greatest gauge of how their access to HCPs will be impacted. This value can be measured on a continuum from “high-touch” to “low-touch” services.

The new role of the pharmaceutical sales rep will include supporting physicians in their care for patients and easing their transition to a more technology-driven practice.

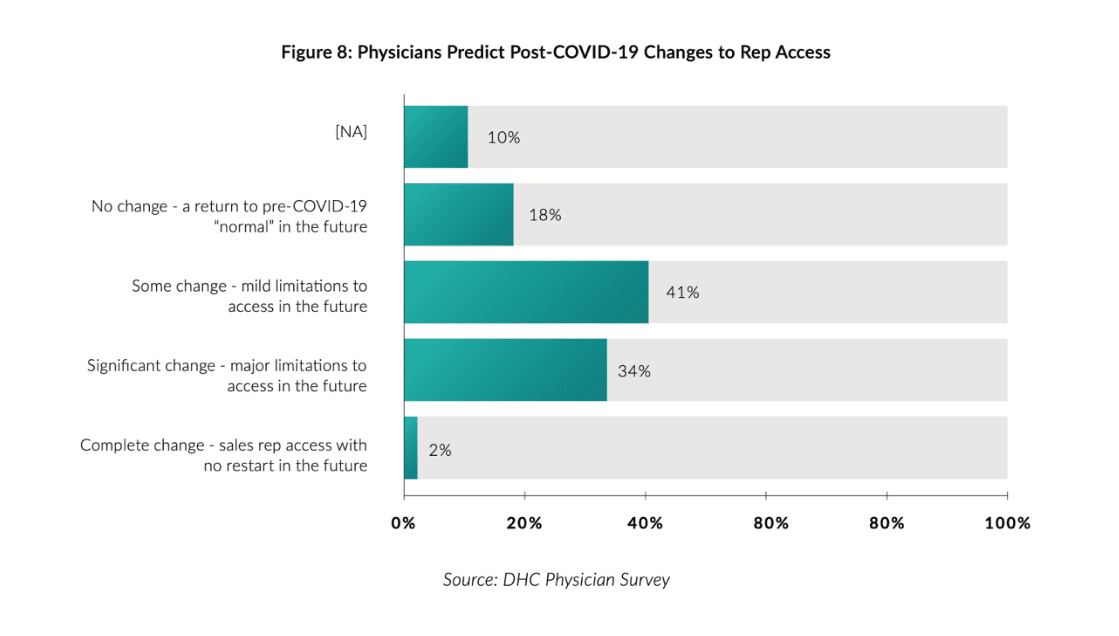

77% of physicians predict a lasting impact on sales rep access in a post-COVID future.

Our physician survey (powered by SERMO) also told us that pharma has an opportunity to increase patient resources and support and sharing those programs with HCPs. We heard from 76% of those surveyed who would like to see enhanced patient assistance programs, including co-pay and financial support. 46% of Physicians also reported interest in enhanced compliance and adherence programs for patients.

We also heard from industry experts like DHC Advisory Board member, David Davidovic. David offered his insights in this interview with Mark Bard, including a cardinal rule “First, we need to respect the customer’s wishes, time and needs.” When offering the following advice to pharma based on our analysis of the HCP landscape, David’s advice was key.

THE AFTERMATH: HCPs will undoubtedly face many new challenges as they need to transform their practices into much more interconnected, digitally driven businesses. This transition will already be challenging for many HCPs, but the added pressure of the speed of change required to adapt to the challenges of COVID-19 makes the effort even more daunting. Many of the technologies involved, such as telemedicine platforms, are still in relative stages of immaturity. As these technologies rapidly evolve and become more integrated, there will emerge many opportunities for pharma to step in and augment the transition to digital within an HCP’s practice.

(see the full report pgs. 20 – 33 for details, including analysis of the impact on the loss of live medical conferences.)

Patient Support Programs and Assistance Move Front and Center

In order to evaluate the impact on patients and patient health outcomes, we conducted surveys of both DHC Group’s pharmaceutical marketers and patient health influencers on the WEGO Health network. Industry members and thought leaders alike agree on several points:

Patients are the group of stakeholders at greatest risk of being affected by COVID-19, and they rated that threat as “significant.”

Patient support programs (PSPs) are a critical support point for patients during the pandemic and should evolve to ease even more of the patients’ financial burden, improve the patient experience, and assist with patients’ overall well-being through beyond-the-pill models.

The pandemic has created opportunities for pharmaceutical manufacturers at the convergence of health and technology:

We will see improvements in the access to and the use of data, as privacy barriers decrease and interoperability increases. This will aid in the pivot to more data-driven media.

Wearables, artificial intelligence (AI), chatbots, contact-tracing tools, and other health technologies will become a larger component of the health ecosystem, presenting opportunities for pharmaceutical manufacturers to create alliances.

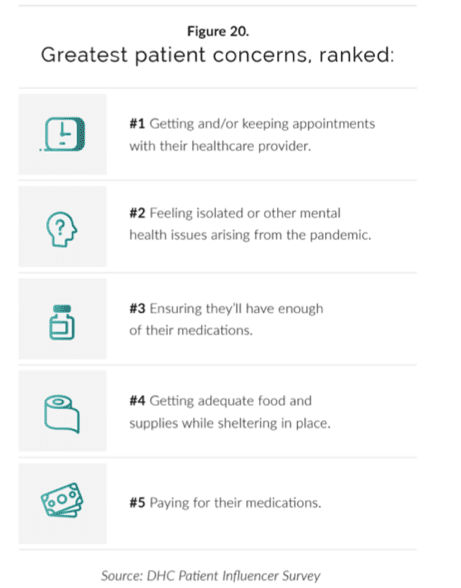

Patient Influencers (through WEGO Health network survey) have indicated top concerns for patients during COVID-19 are continued access to physicians, followed by the impact on mental health. Pharma leaders keyed into the patient needs landscape also zeroed in on the concerns around the patient experience during this unique time. “How can we be of greater service, to come together for the good of the patients?” asked Tricia Brown of Merck. Serina Fischer, VP, Neurodevelopment Franchise of Takeda, agrees. “We are concerned for our patients — for their overall health, their mental health, their access to coverage and care,” she said. “How can we step up to be there for them in new and meaningful ways?”

THE AFTERMATH: An inclusive PSP will need to take into consideration the overall well-being of the patient, certainly including their mental health. Pill-plus programs that emphasize more complete care will win the admiration, attention and loyalty of patients and HCPs alike.

(see the full report pages 34 – 42 for details and additional insights on data privacy impacts)

(see the full report pages 34 – 42 for details and additional insights on data privacy impacts)

New Realities for Brand Launches

The business of bringing new drugs to market is not immune, and pharma co leadership is working hard to ensure success brand launches in both the short and long term. Whether the issue is a delayed launch, a scraped launch plan, or a benched field force, this report offers a toolset for success moving forward.

Among them and of particular interest to digital marketers: Contingency and scenario planning are critical for brands whose launch timing falls in 2020 and 2021; the launch-readiness spectrum can help teams assess their approach based on their brands’ unique factors.

When we asked pharmaceutical industry thought leaders what they believe had been the biggest impact of COVID-19 on the pharma industry so far, a number of them cited the impact on clinical trials, pipelines and launches. “Looking at longer-term repercussions, pharmaceutical companies have had to delay clinical trials and brand launches, which will delay access to much-needed treatments for patients,” said Asaf Evenhaim, CEO, Crossix.

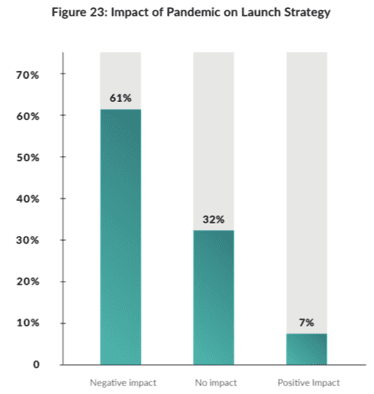

Despite the challenges, clinical trials will conclude and new products will be approved. Then what? What will the product launch of 2021 look like? The majority of pharmaceutical marketers we surveyed — 61% — felt there would be a negative impact on product launch strategy.

Contingency and scenario planning will become critical for brands whose launch timing falls in 2020 and 2021. “The smartest brand teams will be those who build their brand plans with scenarios, instead of just building the brand plan they want,” advised Kim Gariepy, Head of Marketing — Oncology at Pharmacyclics. “If ‘A,’ take this road. If ‘B,’ take another road. And maybe there’s even a plan ‘C’. We will need to be a lot wiser about our opportunities.” Page 48 of The Aftermath offers a launch readiness assessment plan.

One aspect of this assessment is ensuring understanding of the feasibility of sales force deployment. While the fundamental need for information and support around new products remains, it is a reasonable expectation that the downward trend in rep access will apply for launch brands to some degree. Yet, we fully expect rep access to vary by brand and market situation.

THE AFTERMATH: Due to variations in access, launch plans should be designed to support both personal and NPP or virtual engagements augmented by even stronger NPP. Brand teams looking to launch in the wake of COVID-19 will need to take a more remote or virtual approach but can also continue to keep the rep at the center of the interaction. The goal is to readily provide information to HCPs at launch while keeping the rep informed and empowered to provide meaningful physician support.

(see the full report pages 44 – 51 for details and additional insights on topics such as national sales meetings and DTC considerations)

(see the full report pages 44 – 51 for details and additional insights on topics such as national sales meetings and DTC considerations)

Change Management – Embracing Extraordinary Change

COVID-19 brought about organizational changes that happened at a depth and pace many had never witnessed before. In pharma, many saw this as an opportunity to reframe how decisions are made in the future— for the better.

As we surveyed industry members and talked with DHC Advisory Board members, the impact on the pharma co. itself was an often-repeated topic. Within these conversations, several themes emerged, including an anticipated change in how technology use going forward will create more individualized customer experiences and empower better delivery on customer expectations.

We heard again from David Davidovic (Founder, pathForward Strategic Consulting), an expert on the topic: “Life sciences companies have acted incredibly fast as a result of this crisis – pharma has shown an agility we’ve not seen before. They’ve been able to make decisions much faster, with incomplete or ambiguous information, and with less hesitance. I’m hopeful that this experience will give them new confidence, and that they will continue to make those fast and nimble decisions.”

THE AFTERMATH: In the short term, leaders must embrace ambiguity; they must become comfortable with living in the gray area between black and white, and with not having all the answers. Looking forward, the new normal will require the ability to move quickly – in many different contexts, including fully funding patient financial support, adopting new technology and adjusting channel activities.

(see report pages 51 – 55 for details)

(see report pages 51 – 55 for details)

Digital Transformation: Imminent. Inevitable.

The post-COVID normal for pharma is a world digitally transformed. Workforces have gone fully remote and realized an accelerated adoption of technology that few could have anticipated for an industry notorious for its behind-the-curve reputation.

Of course we already had digital leaders in our industry, DHC Group members chief among them, who have tirelessly advocated for and driven forward change. In an interview with Mark Bard, Sanofi’s Mark Gaydos captured the mentality “I think industry, in general, has been moving toward digital. So that we’re not in a situation as an industry of having to convert everything from hardcopy and paper to digital. So hopefully, whether it’s been digital visual aids or websites or other social channels, companies have been moving in that direction; the industry maybe not as quickly as other industries, but certainly we’re there.” (watch the full conversation here)

This report offers a path for evaluation for each marketer reading to do an evaluation of digital maturity, walking through three key drivers:

Creating individualized customer experiences.

Applying technology to deliver on customer expectations.

THE AFTERMATH: The time is now for pharmaceutical companies to double down on digital transformation. “The pharma industry has been talking about digital transformation for years,” said Faruk Capan, CEO, Intouch Group. “But now, it must happen out of necessity, faster and more completely than anyone predicted or was ready for.”

Again, we encourage you to go here to download the full report for much more detail and additional topics not included here. We would also like to thank Intouch Group for their partnership and thought leadership on this important project.